Thin-Film Spintronic Devices 2025–2030: Accelerating Quantum-Grade Data & Sensing Revolution

Thin-Film Spintronic Devices in 2025: Pioneering the Next Era of Ultra-Fast, Energy-Efficient Electronics. Explore How This Disruptive Technology Is Shaping Data Storage, Sensing, and Quantum Applications Worldwide.

- Executive Summary & Key Findings

- Market Size, Growth Rate, and 2025–2030 Forecasts

- Core Technologies: MRAM, Spin Valves, and Tunnel Junctions

- Key Players and Industry Ecosystem (e.g., toshiba.com, samsung.com, ibm.com, ieee.org)

- Emerging Applications: Data Storage, IoT, and Quantum Computing

- Materials Science: Advances in Thin-Film Deposition and Magnetic Materials

- Manufacturing Challenges and Scalability

- Regional Analysis: North America, Europe, Asia-Pacific

- Investment Trends, M&A, and Strategic Partnerships

- Future Outlook: Disruptive Potential and Roadmap to 2030

- Sources & References

Executive Summary & Key Findings

Thin-film spintronic devices are poised to play a transformative role in the electronics industry in 2025 and the coming years, driven by advances in material engineering, device miniaturization, and the growing demand for energy-efficient, high-speed memory and logic solutions. Spintronics, which exploits the intrinsic spin of electrons in addition to their charge, enables devices with non-volatile memory, faster switching speeds, and lower power consumption compared to conventional semiconductor technologies.

In 2025, the commercialization of magnetic random-access memory (MRAM) based on thin-film spintronic structures is accelerating. Major semiconductor manufacturers such as Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) are actively integrating spin-transfer torque (STT) and spin-orbit torque (SOT) MRAM into advanced process nodes, targeting applications in automotive, industrial, and AI edge computing. Samsung Electronics has announced volume production of embedded MRAM (eMRAM) on its 28nm process, with plans to scale to more advanced nodes, while TSMC is collaborating with ecosystem partners to enable MRAM IP for system-on-chip (SoC) designs.

Device performance improvements are being realized through innovations in thin-film deposition techniques and materials. Companies such as Applied Materials and Lam Research are supplying advanced physical vapor deposition (PVD) and atomic layer deposition (ALD) equipment, enabling precise control of magnetic multilayer stacks and interface engineering. These advances are critical for achieving high tunnel magnetoresistance (TMR) ratios, low switching currents, and robust endurance in spintronic devices.

Beyond memory, thin-film spintronic devices are being explored for logic-in-memory architectures and neuromorphic computing, with research collaborations involving industry leaders such as IBM and Intel. These efforts aim to leverage the unique properties of spintronic devices for ultra-low-power, high-density computing platforms.

Key findings for 2025 and the near future include:

- Commercial MRAM adoption is expanding, with leading foundries and IDMs integrating thin-film spintronic memory into mainstream semiconductor processes.

- Equipment and materials suppliers are enabling new device architectures through advanced thin-film deposition and patterning technologies.

- Collaborative R&D is accelerating the transition of spintronic logic and neuromorphic concepts from laboratory to prototype and, eventually, to commercial products.

- Outlook: Continued investment and ecosystem development are expected to drive further scaling, cost reduction, and diversification of thin-film spintronic device applications through 2028 and beyond.

Market Size, Growth Rate, and 2025–2030 Forecasts

The thin-film spintronic devices market is poised for significant expansion in the period from 2025 to 2030, driven by rapid advancements in data storage, memory, and sensor technologies. Spintronics, which exploits the intrinsic spin of electrons in addition to their charge, has enabled the development of devices with higher speed, lower power consumption, and greater data density compared to conventional electronics. Thin-film fabrication techniques are central to the commercial viability of these devices, as they allow for scalable, cost-effective production and integration into existing semiconductor processes.

As of 2025, the market is witnessing robust growth, propelled by increasing demand for high-performance memory solutions such as magnetoresistive random-access memory (MRAM), spin-transfer torque MRAM (STT-MRAM), and advanced magnetic sensors. Major semiconductor manufacturers, including Samsung Electronics and Toshiba Corporation, have invested heavily in the development and commercialization of MRAM technologies, leveraging thin-film spintronic structures for next-generation memory products. Samsung Electronics has announced the scaling up of MRAM production lines, targeting applications in automotive, industrial, and AI edge devices. Similarly, Toshiba Corporation continues to advance spintronic sensor technologies for hard disk drives and industrial automation.

The market size for thin-film spintronic devices in 2025 is estimated to be in the low single-digit billions (USD), with a compound annual growth rate (CAGR) projected in the range of 25–30% through 2030. This growth is underpinned by the increasing adoption of spintronic-based memory in data centers, mobile devices, and IoT infrastructure, as well as the integration of spintronic sensors in automotive safety systems and industrial robotics. Companies such as Infineon Technologies AG and NXP Semiconductors are actively developing and supplying spintronic sensor solutions for automotive and industrial markets, further expanding the addressable market.

Looking ahead, the outlook for 2025–2030 is marked by continued innovation in thin-film deposition techniques, such as atomic layer deposition and sputtering, which are expected to enhance device performance and yield. The emergence of new materials, including Heusler alloys and topological insulators, is anticipated to unlock further improvements in efficiency and scalability. Strategic collaborations between device manufacturers, materials suppliers, and research institutions are likely to accelerate commercialization and standardization efforts. As a result, thin-film spintronic devices are set to play a pivotal role in the evolution of memory, logic, and sensor technologies over the next several years.

Core Technologies: MRAM, Spin Valves, and Tunnel Junctions

Thin-film spintronic devices are at the heart of next-generation memory and logic technologies, leveraging the electron’s spin in addition to its charge. In 2025, the sector is defined by rapid advances in three core technologies: Magnetic Random Access Memory (MRAM), spin valves, and magnetic tunnel junctions (MTJs). These components are increasingly fabricated using sophisticated thin-film deposition and patterning techniques, enabling high-density, low-power, and non-volatile device architectures.

MRAM, particularly the spin-transfer torque (STT-MRAM) and spin-orbit torque (SOT-MRAM) variants, is gaining commercial traction as a universal memory candidate. Major semiconductor manufacturers such as Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) have announced integration of embedded MRAM into advanced process nodes, targeting applications in automotive, industrial, and AI edge devices. Samsung Electronics has demonstrated 1Gb STT-MRAM chips at 28nm and is actively scaling to sub-20nm nodes, while TSMC offers embedded MRAM for its 22nm and 16nm platforms, with further scaling expected in the next few years.

Spin valves, which exploit the giant magnetoresistance (GMR) effect, remain foundational in hard disk drive (HDD) read heads and are now being adapted for advanced sensor applications. Seagate Technology and Western Digital continue to refine thin-film GMR stacks for higher areal density and improved signal-to-noise ratios in HDDs. Meanwhile, companies like NVE Corporation are commercializing spin valve-based sensors for industrial and medical markets, leveraging the sensitivity and miniaturization enabled by thin-film processes.

Magnetic tunnel junctions (MTJs), which utilize the tunneling magnetoresistance (TMR) effect, are the core element in both MRAM and emerging logic-in-memory architectures. TDK Corporation and Toshiba Corporation are leading suppliers of MTJ stacks, focusing on optimizing thin-film interfaces and barrier materials to maximize TMR ratios and device endurance. The industry is also witnessing the first commercial deployments of SOT-MRAM, which promises even faster switching and lower write energy, with Samsung Electronics and TSMC both reporting progress in pilot production.

Looking ahead, the next few years will see further scaling of thin-film spintronic devices to sub-10nm nodes, integration with 3D architectures, and expansion into neuromorphic and quantum computing platforms. The convergence of materials innovation, process control, and device engineering is expected to drive both performance and manufacturability, positioning thin-film spintronic technologies as a cornerstone of future electronics.

Key Players and Industry Ecosystem (e.g., toshiba.com, samsung.com, ibm.com, ieee.org)

The thin-film spintronic devices sector in 2025 is characterized by a dynamic ecosystem of established technology giants, specialized materials suppliers, and collaborative research organizations. These entities are driving innovation in magnetic random-access memory (MRAM), spin-transfer torque (STT) devices, and related applications, leveraging advances in thin-film deposition, nanofabrication, and materials engineering.

Among the most prominent players, Samsung Electronics continues to lead in MRAM commercialization, integrating spintronic memory into its semiconductor portfolio. The company’s 28nm eMRAM technology is already in production, with ongoing efforts to scale down to more advanced nodes and expand adoption in automotive and IoT sectors. Toshiba Corporation is another key innovator, focusing on spintronic logic and memory devices, and collaborating with academic and industrial partners to enhance device endurance and scalability.

In the United States, IBM maintains a strong research presence in spintronics, particularly in the development of spin-based logic and neuromorphic computing elements. IBM’s work on magnetic tunnel junctions (MTJs) and spin-orbit torque (SOT) devices is frequently cited in industry roadmaps and academic literature. Intel Corporation is also investing in spintronic device research, exploring integration with CMOS technology for next-generation memory and logic solutions.

Materials and equipment suppliers play a crucial role in the ecosystem. TDK Corporation and Showa Denko K.K. are leading providers of high-quality magnetic thin films and sputtering targets essential for device fabrication. Their expertise in materials purity and uniformity is vital for achieving the performance and reliability required in commercial spintronic products.

Industry consortia and standards bodies such as the IEEE and the SEMI (Semiconductor Equipment and Materials International) are instrumental in fostering collaboration, setting technical standards, and organizing conferences that accelerate knowledge transfer. These organizations facilitate pre-competitive research and help align the industry on critical challenges such as device scaling, energy efficiency, and manufacturability.

Looking ahead, the thin-film spintronic device ecosystem is expected to see increased cross-sector collaboration, with automotive, data center, and edge computing applications driving demand. The convergence of expertise from semiconductor manufacturers, materials specialists, and research institutions is likely to yield further breakthroughs in device performance and integration, positioning spintronics as a cornerstone of future electronics.

Emerging Applications: Data Storage, IoT, and Quantum Computing

Thin-film spintronic devices are poised to play a transformative role in emerging applications such as data storage, the Internet of Things (IoT), and quantum computing, with significant advancements expected in 2025 and the following years. These devices leverage the electron’s spin in addition to its charge, enabling new functionalities and improved performance over conventional electronics.

In data storage, thin-film spintronic technologies—particularly magnetic tunnel junctions (MTJs) and spin-transfer torque magnetic random-access memory (STT-MRAM)—are gaining traction as next-generation non-volatile memory solutions. Major semiconductor manufacturers such as Samsung Electronics and Toshiba Corporation have announced ongoing investments in MRAM production lines, aiming to address the growing demand for high-speed, energy-efficient memory in data centers and mobile devices. Samsung Electronics has highlighted the scalability and endurance of its embedded MRAM (eMRAM) for system-on-chip (SoC) applications, with commercial deployment expected to expand in 2025. Similarly, Toshiba Corporation continues to develop spintronic memory solutions targeting enterprise storage and automotive electronics.

The IoT sector is also set to benefit from thin-film spintronic devices, particularly due to their low power consumption and non-volatility. Companies like Infineon Technologies are integrating spintronic sensors and memory into IoT modules, enabling always-on, ultra-low-power operation for edge devices. These sensors, based on giant magnetoresistance (GMR) and tunnel magnetoresistance (TMR) effects, are being adopted in smart home, industrial automation, and wearable applications, where reliability and energy efficiency are paramount.

In quantum computing, thin-film spintronic materials are being explored for their potential to serve as qubits and quantum interconnects. Research collaborations involving IBM and Intel Corporation are investigating the use of spin-orbit coupling and topological insulators in thin-film form to realize robust, scalable quantum devices. These efforts are expected to yield prototype spintronic quantum components within the next few years, with the goal of integrating them into hybrid quantum-classical computing architectures.

Looking ahead, the convergence of thin-film spintronic technology with advanced manufacturing and materials science is expected to accelerate commercialization across these sectors. Industry roadmaps from organizations such as the Semiconductor Industry Association indicate that spintronic devices will become increasingly central to the evolution of memory, sensing, and quantum information processing, with widespread adoption anticipated by the late 2020s.

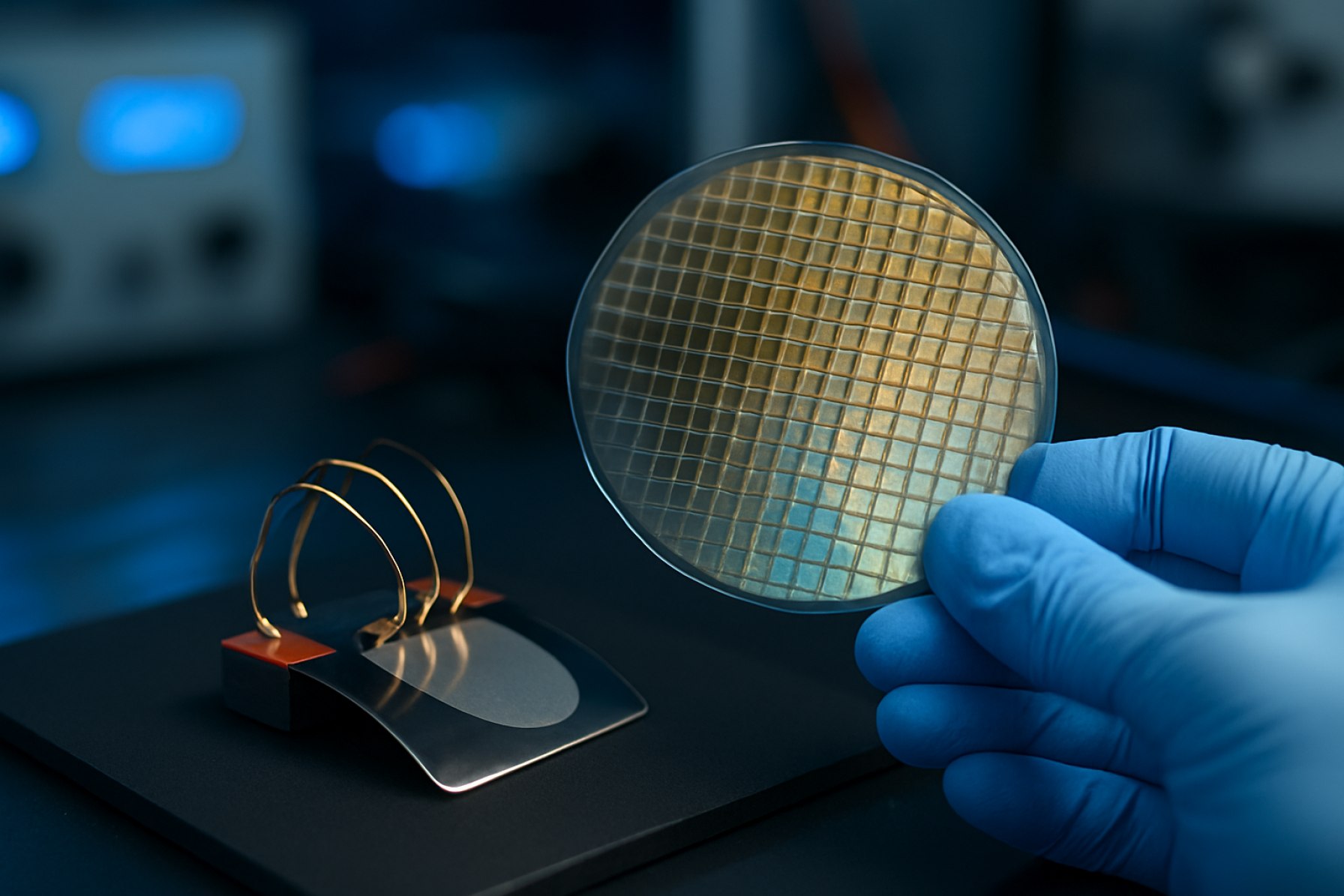

Materials Science: Advances in Thin-Film Deposition and Magnetic Materials

Thin-film spintronic devices are at the forefront of next-generation electronics, leveraging the electron’s spin in addition to its charge to enable new functionalities in memory, logic, and sensing. In 2025, the field is witnessing rapid progress, driven by advances in thin-film deposition techniques and the discovery of novel magnetic materials. These developments are crucial for the realization of high-performance spintronic devices such as magnetic tunnel junctions (MTJs), spin-transfer torque magnetic random-access memory (STT-MRAM), and spin-orbit torque (SOT) devices.

Key industry players are scaling up the commercialization of spintronic memory. Samsung Electronics and Toshiba Corporation have both announced new generations of STT-MRAM products, utilizing advanced sputtering and atomic layer deposition (ALD) to achieve sub-10 nm magnetic layers with high uniformity and low defect density. These thin films, often based on CoFeB/MgO stacks, are essential for achieving high tunneling magnetoresistance (TMR) and low switching currents, which are critical for energy-efficient memory applications.

Material innovation is also accelerating. TDK Corporation and Hitachi Metals are investing in the development of Heusler alloys and synthetic antiferromagnets, which offer enhanced spin polarization and thermal stability. These materials are being integrated into next-generation read heads and sensors, with the goal of supporting higher data densities in hard disk drives and enabling new types of magnetic sensors for automotive and industrial applications.

On the deposition front, companies such as ULVAC, Inc. and Oxford Instruments are supplying advanced magnetron sputtering and molecular beam epitaxy (MBE) systems tailored for the precise growth of ultrathin magnetic and non-magnetic layers. These systems are enabling the fabrication of complex multilayer stacks with atomic-scale control, which is vital for the reproducibility and scalability of spintronic devices.

Looking ahead, the outlook for thin-film spintronic devices remains robust. The integration of two-dimensional (2D) materials, such as graphene and transition metal dichalcogenides, is being actively explored to further reduce device dimensions and enhance spin transport properties. Industry consortia and research alliances, including those involving IBM and Intel Corporation, are expected to accelerate the transition of spintronic technologies from laboratory prototypes to mainstream commercial products over the next few years. As a result, thin-film spintronic devices are poised to play a pivotal role in the evolution of non-volatile memory, neuromorphic computing, and quantum information systems.

Manufacturing Challenges and Scalability

The manufacturing of thin-film spintronic devices in 2025 faces a complex set of challenges, particularly as the industry seeks to transition from laboratory-scale demonstrations to high-volume, cost-effective production. Spintronic devices, which exploit the electron’s spin in addition to its charge, require precise control over thin-film deposition, interface engineering, and defect minimization. The most prominent device architectures—such as magnetic tunnel junctions (MTJs) used in magnetoresistive random-access memory (MRAM)—demand atomic-scale uniformity and reproducibility across large wafers.

One of the primary challenges is the deposition of ultra-thin magnetic and non-magnetic layers, often just a few nanometers thick, with sharp interfaces and minimal interdiffusion. Techniques such as sputtering and atomic layer deposition (ALD) are widely used, but scaling these methods for 300 mm wafers while maintaining tight tolerances remains a significant hurdle. Companies like Applied Materials and Lam Research are actively developing advanced deposition and etch tools tailored for spintronic materials, focusing on uniformity, throughput, and contamination control.

Another critical issue is the integration of spintronic layers with standard CMOS processes. The thermal budgets and process chemistries of conventional semiconductor manufacturing can degrade the delicate magnetic properties of spintronic films. TSMC and Samsung Electronics have both reported progress in integrating MRAM into their advanced logic nodes, but yield and reliability at scale are still under optimization. The need for new metrology tools to characterize spin polarization, interface roughness, and layer thickness in-line is also driving innovation among equipment suppliers.

Defectivity and variability are further bottlenecks. Even minor deviations in layer thickness or composition can lead to significant performance variation in spintronic devices. TDK Corporation and Western Digital, both major players in spintronic-based storage, are investing in advanced process control and in-situ monitoring to address these issues.

Looking ahead, the outlook for scalable manufacturing of thin-film spintronic devices is cautiously optimistic. Industry roadmaps suggest that MRAM and related technologies will see broader adoption in embedded memory and storage-class memory applications by the late 2020s, provided that manufacturing challenges are addressed. Collaborative efforts between equipment makers, foundries, and material suppliers are expected to accelerate process maturity, with pilot lines and early volume production already underway at several leading-edge fabs. However, continued progress will depend on breakthroughs in materials engineering, process integration, and defect control.

Regional Analysis: North America, Europe, Asia-Pacific

The regional landscape for thin-film spintronic devices in 2025 is shaped by robust research ecosystems, strategic investments, and the presence of leading semiconductor and materials companies. North America, Europe, and Asia-Pacific each play distinct roles in the development and commercialization of these advanced devices, with regional strengths influencing the pace and direction of innovation.

North America remains a global leader in spintronics research and early-stage commercialization, driven by the United States’ strong university-industry collaborations and the presence of major technology firms. Companies such as IBM and Intel are actively exploring spintronic memory and logic devices, leveraging their advanced fabrication capabilities and patent portfolios. The region benefits from significant federal funding for quantum and spin-based technologies, with the U.S. Department of Energy and National Science Foundation supporting both fundamental and applied research. In Canada, institutions like the University of Waterloo and companies such as CMC Microsystems contribute to device prototyping and ecosystem development.

Europe is characterized by a strong emphasis on collaborative research and public-private partnerships. The European Union’s Horizon Europe program continues to fund spintronics projects, with a focus on energy-efficient memory and neuromorphic computing. Companies such as Infineon Technologies and STMicroelectronics are at the forefront of integrating spintronic elements into commercial products, particularly in automotive and industrial applications. France’s Crocus Technology and Germany’s TDK-Micronas are notable for their work on magnetic sensors and MRAM. The region’s focus on sustainability and digital sovereignty is expected to drive further investment in spintronic device manufacturing and supply chain localization through 2025 and beyond.

Asia-Pacific is rapidly expanding its footprint in thin-film spintronics, propelled by aggressive investment in semiconductor manufacturing and materials science. Japan’s Toshiba and Fujitsu have pioneered spin-transfer torque MRAM (STT-MRAM) development, while South Korea’s Samsung Electronics and SK hynix are scaling up MRAM production for embedded memory in consumer electronics. In China, state-backed initiatives and companies like SMIC are accelerating research into spintronic logic and memory, aiming to reduce reliance on imported technologies. The region’s robust supply chain and government support position it as a key driver of global spintronic device adoption in the coming years.

Looking ahead, regional competition and collaboration are expected to intensify, with North America focusing on foundational research, Europe on sustainable integration, and Asia-Pacific on large-scale manufacturing and commercialization. This dynamic interplay will shape the global trajectory of thin-film spintronic devices through 2025 and into the latter part of the decade.

Investment Trends, M&A, and Strategic Partnerships

The thin-film spintronic devices sector is experiencing a dynamic phase of investment, mergers and acquisitions (M&A), and strategic partnerships as the industry positions itself for the next wave of growth. In 2025, the convergence of advanced materials science, semiconductor manufacturing, and data-centric applications is driving both established players and emerging startups to intensify their activities in this space.

Major semiconductor manufacturers and materials companies are at the forefront of investment. TDK Corporation, a global leader in magnetic materials and spintronic components, continues to expand its R&D and production capabilities for magnetic tunnel junction (MTJ) and spin-transfer torque (STT) technologies, which are foundational for MRAM and other spintronic memory devices. Similarly, Samsung Electronics and Toshiba Corporation are investing heavily in next-generation MRAM production lines, aiming to commercialize high-density, low-power memory for AI and edge computing applications.

Strategic partnerships are a hallmark of the current landscape. Applied Materials, a leading supplier of semiconductor manufacturing equipment, has announced collaborations with both device manufacturers and materials suppliers to accelerate the integration of spintronic layers into advanced CMOS processes. These alliances are critical for overcoming technical barriers such as interface engineering and scalability, which are essential for mass adoption.

M&A activity is also notable. In recent years, Western Digital has acquired smaller spintronic technology firms to bolster its intellectual property portfolio and accelerate the development of spintronic-based storage solutions. Meanwhile, Seagate Technology is actively scouting for startups specializing in spintronic sensors and read-head technologies, aiming to maintain its leadership in high-capacity hard disk drives.

Venture capital and corporate venture arms are increasingly targeting spintronic startups, particularly those focused on novel thin-film deposition techniques and energy-efficient device architectures. The growing interest from automotive and IoT sectors—where robust, non-volatile memory and advanced sensors are in high demand—further fuels this investment trend.

Looking ahead, the next few years are expected to see continued consolidation as companies seek to secure critical know-how and scale up production. Strategic alliances between device makers, foundries, and materials suppliers will likely intensify, with a focus on overcoming remaining technical hurdles and accelerating commercialization. The sector’s outlook remains robust, underpinned by the expanding application base and the ongoing digital transformation across industries.

Future Outlook: Disruptive Potential and Roadmap to 2030

Thin-film spintronic devices are poised to play a transformative role in the evolution of electronics, data storage, and sensing technologies through 2025 and into the next decade. The core advantage of spintronics—leveraging the electron’s spin in addition to its charge—enables devices with lower power consumption, higher speed, and non-volatility, which are critical for next-generation computing and memory architectures.

In 2025, the commercialization of magnetic random-access memory (MRAM) based on thin-film spintronic structures is accelerating. Major semiconductor manufacturers such as Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) are actively integrating spin-transfer torque (STT) MRAM into advanced process nodes, targeting embedded memory for microcontrollers and system-on-chip (SoC) applications. Samsung Electronics has already announced mass production of embedded MRAM at the 28nm node, with further scaling and performance improvements expected by 2025. Similarly, TSMC is collaborating with partners to develop MRAM solutions for automotive and industrial markets, emphasizing endurance and data retention.

On the materials front, companies like Applied Materials and Lam Research are advancing deposition and etching technologies for ultra-thin magnetic films, which are essential for reliable and scalable spintronic devices. These process innovations are crucial for achieving the uniformity and interface control required for high-density MRAM and emerging spintronic logic devices.

Beyond memory, thin-film spintronics is enabling disruptive sensor technologies. Allegro MicroSystems and TDK Corporation are commercializing magnetoresistive sensors for automotive, industrial, and consumer electronics, leveraging thin-film giant magnetoresistance (GMR) and tunnel magnetoresistance (TMR) effects for high sensitivity and miniaturization. These sensors are expected to see expanded adoption in electric vehicles, robotics, and IoT devices through 2025 and beyond.

Looking toward 2030, the roadmap for thin-film spintronic devices includes the integration of voltage-controlled magnetic anisotropy (VCMA) and spin-orbit torque (SOT) mechanisms, which promise even lower switching energies and faster operation. Industry consortia and research alliances, such as those coordinated by SEMI, are fostering collaboration between material suppliers, equipment manufacturers, and device makers to address scaling, manufacturability, and reliability challenges.

In summary, the next few years will see thin-film spintronic devices move from niche to mainstream, driven by advances in materials, process technology, and system integration. Their disruptive potential lies in enabling ultra-fast, energy-efficient memory and logic, as well as high-performance sensors, setting the stage for a new era in electronics by 2030.

Sources & References

- IBM

- Toshiba Corporation

- Infineon Technologies AG

- NXP Semiconductors

- Seagate Technology

- Western Digital

- IEEE

- Semiconductor Industry Association

- ULVAC, Inc.

- Oxford Instruments

- CMC Microsystems

- STMicroelectronics

- Crocus Technology

- Fujitsu

- SK hynix

- SMIC

- Allegro MicroSystems

Comments (0)