Nickel-Titanium Shape Memory Alloys: Revolutionizing Endovascular Stents in 2025 & Beyond

How Nickel-Titanium Shape Memory Alloys Are Transforming Endovascular Stent Manufacturing in 2025. Explore Market Growth, Breakthrough Technologies, and the Future of Minimally Invasive Vascular Care.

- Executive Summary: Key Insights for 2025

- Market Overview: Size, Segmentation, and 2025–2030 Growth Projections

- Nickel-Titanium Shape Memory Alloys: Properties and Advantages in Stent Manufacturing

- Technological Innovations: Advances in Alloy Processing and Stent Design

- Competitive Landscape: Leading Players and Emerging Innovators

- Regulatory Environment and Quality Standards

- Market Drivers and Challenges: Clinical Demand, Cost, and Supply Chain Factors

- Forecast Analysis: CAGR of 8.2% Through 2030 and Revenue Projections

- Future Outlook: Next-Generation Alloys, Smart Stents, and Expansion into New Therapeutic Areas

- Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: Key Insights for 2025

Nickel-titanium shape memory alloys (NiTi SMAs), commonly known as Nitinol, have become a cornerstone material in the manufacturing of endovascular stents due to their unique superelasticity and shape memory properties. As the global demand for minimally invasive cardiovascular interventions continues to rise, the use of NiTi SMAs in stent production is expected to see significant growth in 2025. This executive summary highlights the key insights shaping the market and technological landscape for NiTi SMA-based endovascular stents in the coming year.

One of the primary drivers for the adoption of NiTi SMAs is their ability to undergo substantial deformation and return to their original shape upon unloading or heating, which is critical for stent deployment and vessel conformity. This property enables the design of self-expanding stents that can be delivered through narrow catheters and then expand reliably within the vasculature, reducing the risk of vessel trauma and improving patient outcomes. Leading medical device manufacturers, such as Boston Scientific Corporation and Medtronic plc, continue to invest in advanced NiTi stent platforms, focusing on enhanced flexibility, fatigue resistance, and biocompatibility.

In 2025, regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Commission are expected to maintain stringent standards for material characterization, traceability, and long-term performance of NiTi-based stents. This regulatory focus is driving innovation in alloy processing, surface modification, and quality assurance, with manufacturers increasingly collaborating with material suppliers such as Memry Corporation and Nitinol Devices & Components to ensure compliance and product reliability.

Key trends for 2025 include the integration of digital manufacturing technologies, such as laser cutting and additive manufacturing, to enable complex stent geometries and personalized solutions. Additionally, research into drug-eluting NiTi stents and bioresorbable coatings is gaining momentum, aiming to further reduce restenosis rates and improve long-term vascular healing. As the clinical evidence base expands and healthcare systems prioritize minimally invasive therapies, NiTi SMAs are poised to remain at the forefront of endovascular stent innovation.

Market Overview: Size, Segmentation, and 2025–2030 Growth Projections

The market for nickel-titanium (NiTi) shape memory alloys (SMAs) in endovascular stent manufacturing is poised for robust growth between 2025 and 2030, driven by the increasing prevalence of cardiovascular diseases and the expanding adoption of minimally invasive procedures. NiTi SMAs, commonly known as Nitinol, are prized for their superelasticity and biocompatibility, making them the material of choice for self-expanding stents used in vascular interventions.

In 2025, the global market size for NiTi SMAs in endovascular stent applications is estimated to be in the range of several hundred million USD, with North America and Europe accounting for the largest shares due to advanced healthcare infrastructure and high procedural volumes. Asia-Pacific is expected to witness the fastest growth, propelled by rising healthcare investments and increasing awareness of endovascular therapies.

Segmentation within this market is primarily based on stent type (coronary, peripheral, neurovascular), end-user (hospitals, ambulatory surgical centers), and geography. Coronary stents represent the largest segment, reflecting the high incidence of coronary artery disease and the established clinical efficacy of NiTi-based devices. Peripheral and neurovascular stents are also gaining traction, supported by ongoing innovation in device design and expanding indications.

From 2025 to 2030, the market is projected to grow at a compound annual growth rate (CAGR) exceeding 8%, fueled by technological advancements in NiTi alloy processing, such as improved fatigue resistance and enhanced radiopacity. Leading manufacturers, including Boston Scientific Corporation, Medtronic plc, and Terumo Corporation, are investing in next-generation stent platforms that leverage the unique properties of NiTi SMAs to improve patient outcomes and procedural efficiency.

Regulatory approvals and reimbursement policies will continue to shape market dynamics, with agencies such as the U.S. Food and Drug Administration and the European Medicines Agency playing pivotal roles in facilitating the introduction of innovative NiTi-based stent technologies. As the global burden of vascular diseases rises and healthcare systems prioritize minimally invasive solutions, the demand for NiTi SMAs in endovascular stent manufacturing is expected to accelerate, solidifying its position as a critical segment within the broader medical device materials market.

Nickel-Titanium Shape Memory Alloys: Properties and Advantages in Stent Manufacturing

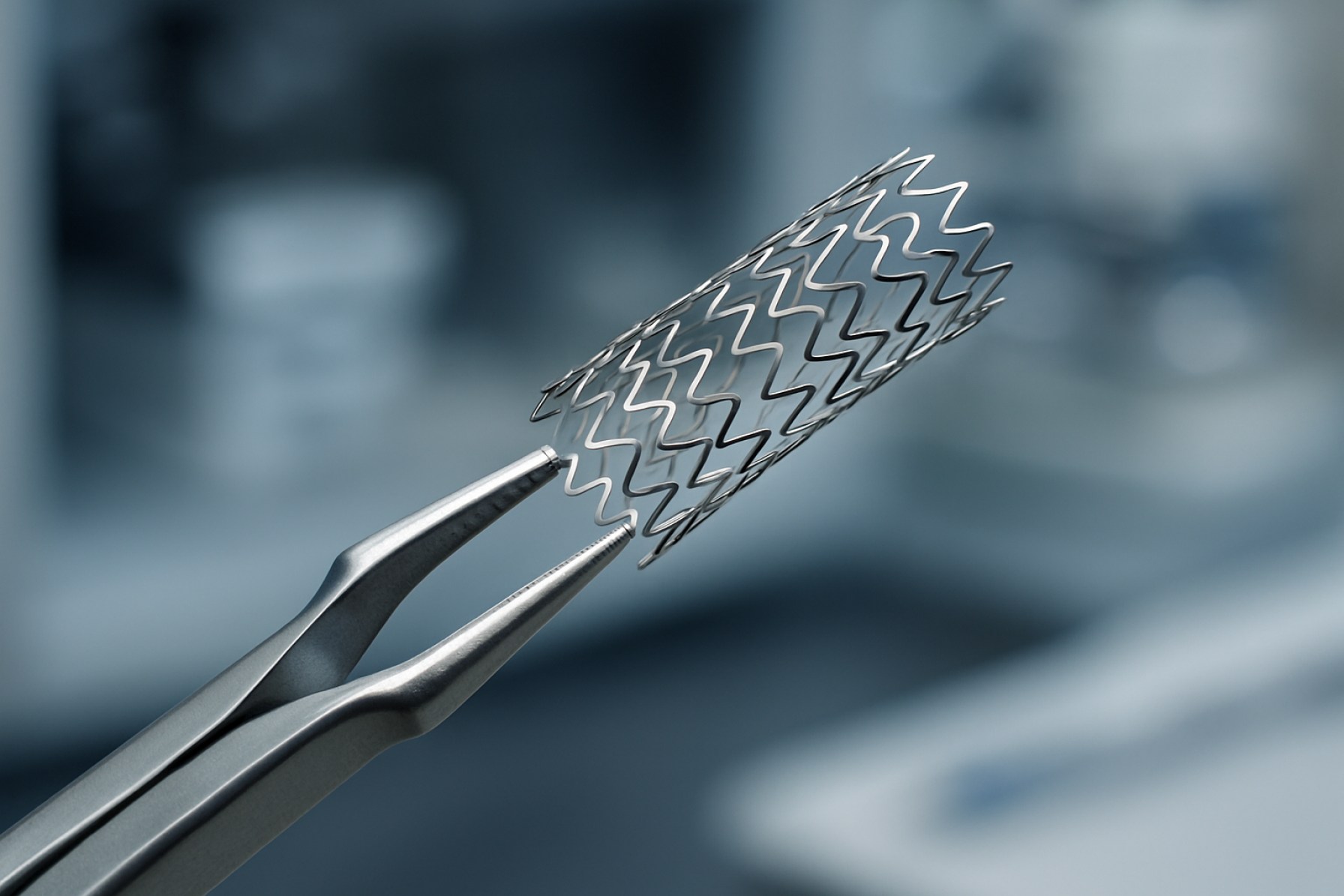

Nickel-titanium shape memory alloys (SMAs), commonly referred to as Nitinol, have become a cornerstone material in the manufacturing of endovascular stents due to their unique combination of mechanical properties and biocompatibility. The defining characteristic of Nitinol is its ability to undergo deformation at one temperature and then recover its original, pre-deformed shape upon heating—a phenomenon known as the shape memory effect. Additionally, Nitinol exhibits superelasticity, allowing it to withstand significant strains and return to its original form without permanent deformation, even at body temperature.

These properties are particularly advantageous in the context of endovascular stents, which must be delivered through narrow, tortuous vascular pathways and then expand reliably to support vessel walls. The superelastic behavior of Nitinol enables stents to be compressed into small delivery systems and then self-expand upon deployment, conforming to the vessel’s anatomy and maintaining consistent radial force. This reduces the risk of vessel trauma and improves procedural outcomes compared to traditional stainless steel stents.

Nitinol’s corrosion resistance is another critical advantage, as it minimizes the risk of metal ion release and subsequent inflammatory responses within the body. The alloy forms a stable titanium oxide layer on its surface, enhancing its biocompatibility and reducing the likelihood of adverse reactions. This property is recognized and leveraged by leading medical device manufacturers such as Boston Scientific Corporation and Medtronic plc in their stent product lines.

Furthermore, the fatigue resistance of Nitinol is superior to many other metals used in medical devices. This is essential for stents, which are subjected to millions of cycles of pulsatile blood flow over their lifetime. The durability of Nitinol stents contributes to their long-term patency and reduces the need for repeat interventions. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) have acknowledged the safety and efficacy of Nitinol-based stents, further supporting their widespread adoption.

In summary, the unique combination of shape memory, superelasticity, corrosion resistance, and fatigue durability makes nickel-titanium SMAs the material of choice for next-generation endovascular stent manufacturing, offering significant clinical and procedural advantages over conventional materials.

Technological Innovations: Advances in Alloy Processing and Stent Design

Recent years have witnessed significant technological innovations in the processing of nickel-titanium (NiTi) shape memory alloys (SMAs) and the design of endovascular stents, driving improvements in device performance, safety, and patient outcomes. NiTi alloys, commonly known as Nitinol, are prized for their superelasticity and shape memory effect, properties that are critical for minimally invasive vascular interventions. Advances in alloy processing have focused on refining the microstructure and composition of NiTi to enhance fatigue resistance, corrosion resistance, and biocompatibility. Techniques such as vacuum arc remelting, precision thermomechanical treatments, and surface modification processes have enabled manufacturers to produce stents with highly controlled transformation temperatures and mechanical properties tailored to specific clinical applications.

Laser cutting technology has evolved to allow for the fabrication of intricate stent geometries from NiTi tubes, enabling the creation of ultra-thin struts and complex scaffolding patterns that optimize flexibility and radial strength. Post-processing steps, including electropolishing and heat setting, further improve the surface finish and mechanical consistency of the stents, reducing the risk of thrombosis and enhancing long-term durability. Companies such as Boston Scientific Corporation and Medtronic plc have integrated these advanced manufacturing techniques into their product lines, resulting in next-generation stents that can better conform to tortuous vascular anatomies and withstand repetitive physiological loading.

In parallel, stent design has evolved to address clinical challenges such as restenosis, migration, and vessel trauma. Computational modeling and finite element analysis are now routinely employed to optimize stent architecture, balancing the need for radial force with flexibility and minimizing chronic outward force on vessel walls. Innovations such as drug-eluting coatings, bioresorbable polymer sleeves, and hybrid designs that combine NiTi with other biocompatible materials are being explored to further improve patient outcomes. Regulatory bodies like the U.S. Food and Drug Administration have provided updated guidance on the evaluation of these advanced devices, ensuring that new stent technologies meet stringent safety and efficacy standards.

Looking ahead to 2025, the convergence of material science, precision engineering, and digital design tools is expected to yield even more sophisticated NiTi-based endovascular stents, with ongoing research focused on smart stents capable of real-time monitoring and adaptive responses to physiological changes.

Competitive Landscape: Leading Players and Emerging Innovators

The competitive landscape for nickel-titanium (NiTi) shape memory alloys (SMAs) in endovascular stent manufacturing is characterized by a blend of established industry leaders and dynamic emerging innovators. NiTi alloys, commonly known as Nitinol, are prized for their superelasticity and biocompatibility, making them the material of choice for self-expanding stents used in minimally invasive vascular interventions.

Among the leading players, Boston Scientific Corporation and Medtronic plc have maintained strong positions through extensive portfolios of Nitinol-based stents and continuous investment in R&D. These companies leverage proprietary alloy processing techniques to enhance stent flexibility, fatigue resistance, and deliverability. Abbott Laboratories is another major player, with a focus on peripheral and coronary stents that utilize advanced Nitinol designs for improved patient outcomes.

On the materials supply side, Memry Corporation and Nitinol Devices & Components (NDC) are recognized for their expertise in producing high-purity, medical-grade Nitinol. These suppliers collaborate closely with device manufacturers to tailor alloy properties for specific stent applications, ensuring compliance with stringent regulatory standards.

Emerging innovators are reshaping the competitive landscape by introducing novel manufacturing methods and stent designs. Companies such as Terumo Corporation and BIOTRONIK SE & Co. KG are developing next-generation Nitinol stents with enhanced surface modifications to reduce restenosis and improve endothelialization. Startups and academic spin-offs are also exploring additive manufacturing and laser micromachining to create ultra-thin, highly conformable stent structures that address unmet clinical needs.

Strategic partnerships and acquisitions are common, as established firms seek to integrate innovative technologies and expand their product offerings. The competitive environment is further shaped by evolving regulatory requirements and the need for robust clinical evidence, driving both established and emerging players to invest in advanced testing and validation.

Overall, the market for NiTi SMAs in endovascular stent manufacturing in 2025 is marked by technological innovation, collaboration across the value chain, and a focus on improving patient outcomes through superior device performance.

Regulatory Environment and Quality Standards

The regulatory environment and quality standards for nickel-titanium (NiTi) shape memory alloys (SMAs) used in endovascular stent manufacturing are stringent, reflecting the critical role these devices play in patient health and safety. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Commission (under the Medical Device Regulation, MDR) require comprehensive premarket submissions, including biocompatibility, mechanical performance, and corrosion resistance data for NiTi stents. Manufacturers must demonstrate that their products meet the essential requirements for safety and efficacy, with particular attention to the unique properties of NiTi alloys, such as superelasticity and shape memory effect.

Quality standards for NiTi alloys are governed by international norms, notably ISO 25539-1 and ISO 25539-2, which specify requirements for endovascular devices, including stents. These standards address aspects such as fatigue resistance, radial strength, and dimensional tolerances, all of which are critical for the long-term performance of NiTi stents. Additionally, ISO 10993 series standards guide the biological evaluation of medical devices, ensuring that NiTi alloys do not elicit adverse tissue reactions or release harmful nickel ions above acceptable thresholds.

Traceability and process control are emphasized throughout the manufacturing lifecycle. Companies must implement robust quality management systems, typically certified under ISO 13485, to ensure consistent production and documentation. This includes rigorous incoming material inspection, in-process monitoring, and final product testing. Surface finishing and passivation processes are closely regulated to minimize the risk of corrosion and nickel ion release, with manufacturers often required to provide detailed validation data to regulatory authorities.

Post-market surveillance is another key regulatory requirement. Manufacturers are obligated to monitor the clinical performance of NiTi stents, report adverse events, and, if necessary, initiate corrective actions. Regulatory bodies such as the FDA and the European Medicines Agency (EMA) provide frameworks for ongoing safety monitoring and reporting.

In summary, the regulatory landscape for NiTi shape memory alloys in endovascular stent manufacturing is characterized by rigorous standards and oversight, ensuring that these advanced materials deliver safe and effective clinical outcomes.

Market Drivers and Challenges: Clinical Demand, Cost, and Supply Chain Factors

The market for nickel-titanium (NiTi) shape memory alloys (SMAs) in endovascular stent manufacturing is shaped by a complex interplay of clinical demand, cost considerations, and supply chain dynamics. The unique superelasticity and biocompatibility of NiTi alloys have made them the material of choice for next-generation stents, particularly in minimally invasive vascular interventions. Clinical demand is driven by the rising global incidence of cardiovascular diseases and the growing preference for less invasive procedures, which require stents that can navigate tortuous anatomy and adapt to dynamic vessel environments. This has led to increased adoption of NiTi-based stents, as highlighted by leading medical device manufacturers such as Medtronic and Boston Scientific Corporation.

However, the high cost of NiTi alloys remains a significant challenge. The manufacturing process for medical-grade NiTi is complex, involving precise control of composition and thermomechanical treatments to achieve the desired shape memory and superelastic properties. This complexity translates into higher raw material and processing costs compared to conventional stent materials like stainless steel or cobalt-chromium alloys. Additionally, the need for stringent quality assurance and regulatory compliance further elevates production expenses, impacting the overall cost structure for device manufacturers.

Supply chain factors also play a critical role in the NiTi stent market. The sourcing of high-purity nickel and titanium, as well as the specialized facilities required for alloy production, can be vulnerable to geopolitical and economic fluctuations. Disruptions in the supply of these critical raw materials may lead to production delays or increased costs. Companies such as Nitinol Devices & Components (a Confluent Medical company) have invested in vertically integrated supply chains to mitigate these risks and ensure consistent quality and availability of NiTi components.

In summary, while clinical demand for NiTi stents continues to grow due to their superior performance in endovascular applications, manufacturers must navigate the challenges of high material costs and supply chain vulnerabilities. Ongoing innovation in alloy processing and supply chain management will be essential to maintain market growth and meet the evolving needs of healthcare providers and patients.

Forecast Analysis: CAGR of 8.2% Through 2030 and Revenue Projections

The market for nickel-titanium (NiTi) shape memory alloys (SMAs) in endovascular stent manufacturing is poised for robust growth, with a projected compound annual growth rate (CAGR) of 8.2% through 2030. This forecast is underpinned by several converging factors, including the rising prevalence of cardiovascular diseases, increasing adoption of minimally invasive procedures, and ongoing advancements in stent design and material science.

Revenue projections for the NiTi SMA segment in endovascular stents are expected to surpass USD 2.1 billion by 2030, up from an estimated USD 1.2 billion in 2025. This growth trajectory is driven by the superior properties of NiTi alloys—such as superelasticity, biocompatibility, and corrosion resistance—which make them ideal for next-generation stent platforms. These attributes enable stents to better conform to complex vascular anatomies and maintain patency, reducing the risk of restenosis and improving patient outcomes.

Key industry players, including Boston Scientific Corporation, Medtronic plc, and Terumo Corporation, are investing heavily in research and development to enhance the performance and durability of NiTi-based stents. Their efforts are further supported by collaborations with material suppliers such as Nitinol Devices & Components and Memry Corporation, which are focused on refining alloy compositions and manufacturing processes.

Geographically, North America and Europe are expected to maintain their dominance in market share, owing to advanced healthcare infrastructure and high adoption rates of endovascular procedures. However, the Asia-Pacific region is anticipated to witness the fastest growth, fueled by expanding healthcare access, rising awareness of vascular diseases, and increasing investments in medical device manufacturing.

Looking ahead, the integration of digital health technologies and personalized medicine approaches is likely to further accelerate market expansion. Regulatory support from agencies such as the U.S. Food and Drug Administration and the European Commission is also expected to streamline product approvals, facilitating faster time-to-market for innovative NiTi stent solutions.

Future Outlook: Next-Generation Alloys, Smart Stents, and Expansion into New Therapeutic Areas

The future of nickel-titanium (NiTi) shape memory alloys in endovascular stent manufacturing is poised for significant advancements, driven by ongoing research into next-generation alloys, the integration of smart technologies, and the expansion of stent applications into new therapeutic areas. As the demand for minimally invasive vascular interventions grows, manufacturers and researchers are focusing on enhancing the performance, safety, and versatility of NiTi-based stents.

Next-generation NiTi alloys are being engineered to offer improved fatigue resistance, corrosion resistance, and biocompatibility. Alloying elements such as tantalum, platinum, or chromium are being explored to fine-tune transformation temperatures and mechanical properties, enabling stents to better withstand the dynamic environment of the vascular system. These innovations aim to reduce the risk of stent fracture and restenosis, ultimately improving long-term patient outcomes. Companies like Nitinol Devices & Components and Memry Corporation are at the forefront of developing and supplying advanced NiTi materials tailored for medical device applications.

The integration of smart technologies into NiTi stents represents another promising frontier. Researchers are investigating the incorporation of sensors and drug-eluting coatings into stent designs, enabling real-time monitoring of vascular healing and targeted drug delivery. These “smart stents” could provide clinicians with valuable data on blood flow, pressure, and restenosis risk, facilitating personalized patient management. Collaborative efforts between medical device manufacturers and technology companies, such as those led by Medtronic plc and Boston Scientific Corporation, are accelerating the development of these next-generation devices.

Beyond traditional cardiovascular applications, NiTi stents are being adapted for use in new therapeutic areas, including neurovascular, peripheral vascular, and non-vascular interventions. For example, self-expanding NiTi stents are increasingly used in the treatment of intracranial aneurysms and peripheral artery disease, as well as in urology and gastroenterology. Regulatory approvals and clinical trials, supported by organizations such as the U.S. Food and Drug Administration and the European Medicines Agency, are paving the way for broader adoption of NiTi stents across diverse medical specialties.

In summary, the future outlook for NiTi shape memory alloys in endovascular stent manufacturing is characterized by material innovation, the emergence of smart stent technologies, and the expansion into new therapeutic domains, promising improved patient care and expanded clinical utility.

Strategic Recommendations for Stakeholders

Strategic recommendations for stakeholders involved in the development and manufacturing of endovascular stents using nickel-titanium shape memory alloys (NiTi SMAs) should focus on innovation, regulatory compliance, supply chain resilience, and collaborative partnerships. As the demand for minimally invasive vascular interventions grows, NiTi SMAs remain a material of choice due to their superelasticity and biocompatibility. However, stakeholders must navigate evolving clinical requirements, technological advancements, and global market dynamics to maintain competitiveness.

- Invest in Advanced Manufacturing Technologies: Stakeholders should prioritize the adoption of precision manufacturing techniques such as laser cutting, additive manufacturing, and surface modification to enhance stent performance and customization. These technologies can improve product consistency, reduce material waste, and enable the development of next-generation stent designs with optimized mechanical properties.

- Strengthen Regulatory Strategy: Given the stringent regulatory landscape for medical devices, early and proactive engagement with regulatory bodies such as the U.S. Food and Drug Administration and the European Commission is essential. Stakeholders should invest in robust preclinical and clinical validation, and ensure compliance with evolving standards for biocompatibility, fatigue resistance, and long-term safety.

- Secure and Diversify Supply Chains: The supply of high-purity nickel and titanium is critical for consistent NiTi SMA quality. Manufacturers should establish relationships with reputable suppliers such as ATI and Carpenter Technology Corporation, and consider geographic diversification to mitigate risks associated with geopolitical instability or raw material shortages.

- Foster Cross-Disciplinary Collaboration: Collaboration between material scientists, biomedical engineers, clinicians, and device manufacturers is vital for translating material innovations into clinically effective stent products. Partnerships with academic institutions and research organizations, such as the National Institute of Biomedical Imaging and Bioengineering, can accelerate R&D and facilitate access to cutting-edge testing facilities.

- Monitor Market and Clinical Trends: Stakeholders should continuously monitor emerging clinical needs, such as stents for complex anatomies or drug-eluting capabilities, and adapt product portfolios accordingly. Engaging with professional societies like the Society for Cardiovascular Angiography & Interventions can provide valuable insights into evolving practitioner preferences and patient outcomes.

By implementing these strategic recommendations, stakeholders can enhance their competitive positioning, ensure regulatory compliance, and contribute to the advancement of endovascular therapies using nickel-titanium shape memory alloys.

Sources & References

- Boston Scientific Corporation

- Medtronic plc

- European Commission

- Terumo Corporation

- European Medicines Agency

- Terumo Corporation

- BIOTRONIK SE & Co. KG

- ATI

- Carpenter Technology Corporation

- National Institute of Biomedical Imaging and Bioengineering

Comments (0)